Seagate has followed Western Digital in raising the prices of hard drives, attributing the increase to the surging demand driven by AI's substantial data needs. This demand is also fuelling a swift rise in orders for Enterprise solid-state drives (SSDs).

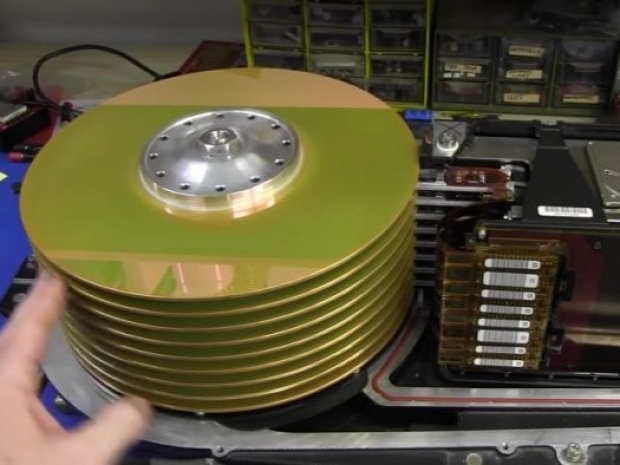

As one of the top three producers of traditional rotating hard disk drives (HDDs), Seagate has notified customers of immediate price increases for new orders and any modifications to orders that exceed previously agreed quantities.

Analyst Trendforce said that the problem is due to heightened demand for high-capacity HDD products spurred by the AI boom and a reduction in production by hard drive manufacturers. This renders them unable to satisfy this demand, leading to escalating prices.

The increased demand stems from AI training, which necessitates vast data volumes; for instance, OpenAI's GPT-3 model reportedly trained on 45TB of data, a figure likely exceeded by newer models. Although flash-based SSDs offer high speed and low latency, exclusive reliance on flash storage remains expensive. Last year, Seagate introduced a 30TB hard drive line.

Hard drive production has been reduced by up to 20 per cent over the past couple of years due to diminished orders amid the pandemic, leaving manufacturers ill-prepared for the recent surge in demand.

Seagate boss Finis Conner blamed COVID-19's impact on global business and manufacturing, which led to a decrease in disk drive and cloud storage demand, resulting in an excess supply of hard drives. Although temporary, Conner noted that this surplus negatively affects sales and HDD stock values.

He cautioned that reigniting the HDD production engine could be a lengthy process, and with only three global suppliers—Seagate, Western Digital, and Toshiba—buyers may encounter elevated prices for some time.

Trendforce anticipates ongoing supply shortages for high-capacity HDD products this quarter and possibly throughout the year. HDD prices are expected to rise further in the second quarter, with an estimated 5-10 percent increase.

The analyst firm also suggests that AI drives the demand for QLC enterprise SSDs, particularly for inferencing servers in North America.

According to Trendforce, projected bit shipments of QLC enterprise SSDs are set to hit 30 exabytes in 2024, marking a fourfold growth from 2023.

QLC, or quad-level cell, is a NAND flash memory technology optimised for capacity. It can store four bits of data per cell, thus boosting capacity and reducing the cost per GB.

Trendforce notes that QLC SSDs are increasingly used for AI applications because inferencing servers primarily execute read operations, where SSDs have a speed advantage. Enterprise SSDs also use less power and are more compact than HDDs.

The report states that Samsung commanded over 40 per cent of the enterprise SSD market share in Q4 of 2023, with Solidigm (an SK Hynix brand) at 32 per cent.

Solidigm plans to increase production of 144-layer devices in the latter half of 2024, while Samsung, focusing on 176-layer devices and facing little competition, is poised to benefit from the limited supply of high-capacity QLC products.

This situation will likely push enterprise SSD contract prices upward through Q3, with another projected quarterly increase of 5 to 10 per cent.